As I have already documented, I sold all of my stocks in May 2008. I feel fortunate, but I know of no one else that has escaped this economic crisis unscathed. The sordid details of the Madoff scandal and the avarice of AIG are just surfacing now. It is riveting how misplaced were our confidences with our financial security. Confucius said “May you live in interesting times.” And this is so very true. I put together these thoughts to help people navigate through these uncertain and interesting times.

As I have already documented, I sold all of my stocks in May 2008. I feel fortunate, but I know of no one else that has escaped this economic crisis unscathed. The sordid details of the Madoff scandal and the avarice of AIG are just surfacing now. It is riveting how misplaced were our confidences with our financial security. Confucius said “May you live in interesting times.” And this is so very true. I put together these thoughts to help people navigate through these uncertain and interesting times.

Wall Street = High Risk ≠ Financial Security

I remember after I left Gateway, I met a financial adviser from Edward Jones. He showed me a chart which showed the returns in Wall Street over the last 50 years. The message was clear, if you leave your money in the stock market for an extended period, you will always get a return. Always. You just cannot get nervous and sell. Holding is good, selling is bad.

We see the same message in the television advertisements for the financial agencies. Save your money, trust us, and we will prepare you for retirement.

At best, their marketing is exaggerated, and at worst, it can be considered a sham. The reality is that the stock market is in essence a risky place to invest your money. Unless you have the stomach to lose a substantial portion of the principal you saved, your money should never enter into the stock market.

Wall Street is like eBay

If the stock market is so risky with so much downside risk, then why does the stock market keep going up? The stock market is very similar to an auction at eBay. Imagine suddenly there is a large influx of buyers at eBay and the number of sellers stays flat. The average price at eBay would rocket. That’s what has been happened in the stock market!

First, the financial agencies have been marketing heavily to trust them with your retirement money. It is working. The United States has by far the highest household penetration in the stock market. 45% of US households participate in the stock market versus just 15% in Germany.

A good chunk of participation occurs through 401K’s and IRA’s. Both of these mechanisms are legals ways to funnel more money into the stock market. In fact, it is better than normal money because money in 401K’s and IRA’s tends to buy and hold. The overall effect is that they make the stock market go up.

The key message here is that Wall Street’s principle role was to attract more money into the stock market. As long as new money was entering the market, the tide would rise and all stocks would improve. As a matter of fact, one huge way to attract more money recently failed. Imagine the stock market bump, if they managed to privatize social security. All of that money would have gone into the stock market.

Low interest rate era is almost over

Complicit in all of this is our government, or better known as the Fed. During the last 15 years, the Fed has embarked on a policy of low interest rates. Their belief has been that low interest rates encourages businesses and individuals to borrow which creates economic growth.

Additionally, low interest rates move money away from safe investments such as US treasuries to higher risk investments such as the stock market. In fact, it has been like clock work for the last 15 years. The Fed lowers interest rates, and the Dow and the Nasdaq get a nice bump.

As I have already discussed, now that interest rates are approaching zero, there are no more bullets in the gun. Now what? Wall Street can only go in one direction, and that is DOWN. This is when it becomes clear that Wall Street cannot live up to their marketing hype. Millions and millions of Americans, including myself, bought the hype, and pinned their retirement hopes on Wall Street. Now of all those hopes have been suspended.

Which brings us to the final saga of US monetary policy. With interest rates essentially at zero, who will fund our debt in the future? Up to this point, China, Saudi Arabia, and others have been willing to pony up. But with economic problems of their own, zero is starting to sound like a crummy deal. It seems that there are only two outcomes. The dollar will take a nose dive becoming one of the weaker currencies in the world. The other and more likely option is to let interest rates rise to help finance our debt. Either way, Wall Street will take another hit dashing the dwindling hopes of American retired couples.

Portfolio Statement is not your bank statement

Every month we receive statements from our Wall Street brokerage firms. They do a simple mathematical calculation to determine the value of the portfolio. They multiply the number of shares times the last transacted stock price. This is inherently flawed. Your stock portfolio is not worth that amount because there is no guarantee that you can get that price when you sell. They are called paper profits.

But the sham is worse than this. Certainly, on the day you receive your statement, you could sell your shares, and you would receive more or less the value on your statement. However, it falls apart quickly, because the last transaction price cannot represent the price for all of the shares. On any given day, if there are more sellers than buyers, the price drops quickly.

Here’s the problem. I have trained myself, as well as the rest of America, to view my stock portfolio statement similar to my bank statement. When my bank balance is up, I am more wealthy, and when it goes down, I am less. Unfortunately, this simple principle does not extend to stocks. You are not more wealthy until you sell your stocks and never before. Wall Street is truly encouraging people to count their eggs before they are hatched.

Wall Street is not a surrogate for the health of the economy.

Here’s the last Wall Street myth I want to debunk. We have all been trained to view Wall Street and the Dow Jones Industrial average as a key indicator of the US economy. In fact, as unemployment and GDP statistics come through, Wall Street acts in knee jerk be it positive or negative. But that’s where it ends. The reality is that during the last 8 years, Wall Street was up, but the economy was not. We were led down a golden brick road of prosperity, but there is no pot of gold at the end of this rainbow.

Conclusions

The lesson is pure and simple. Wall Street is for high risk – high reward individuals. One should not be investing in the stock market with their retirement money. Unfortunately, Americans have few good options. Keep your money in savings at a paltry interest rate, or put it all on the line in the stock market. Personally, I have been moving my money out of the country, but few Americans have this alternative easily at their disposal.

It is indeed ironic that outside Wall Street is a statue of a large Golden Bull. My final conclusion is that

Wall Street is a lot of Bull but it is far from golden.

As I have already documented, I sold all of my stocks in May 2008. I feel fortunate, but I know of no one else that has escaped this economic crisis unscathed. The sordid details of the Madoff scandal and the avarice of AIG are just surfacing now. It is riveting how misplaced were our confidences with our financial security. Confucius said “May you live in interesting times.” And this is so very true. I put together these thoughts to help people navigate through these uncertain and interesting times.

As I have already documented, I sold all of my stocks in May 2008. I feel fortunate, but I know of no one else that has escaped this economic crisis unscathed. The sordid details of the Madoff scandal and the avarice of AIG are just surfacing now. It is riveting how misplaced were our confidences with our financial security. Confucius said “May you live in interesting times.” And this is so very true. I put together these thoughts to help people navigate through these uncertain and interesting times. This post is called the Double Bubble, because it is clear that there have been two very significant bubbles to ripple through the world in the last 15 years. Just looking at the Dow Jones Industrial average, there is a bubble which begins circa 1995 and bottoms out circa 2003. Immediately after the tech bubble bottoms, a new bubble begins to form, which is the crisis we face today. As has already been discussed in previous blogs, Greenspan intentionally created a second bubble by lowering interest rates after the Tech Bubble popped.

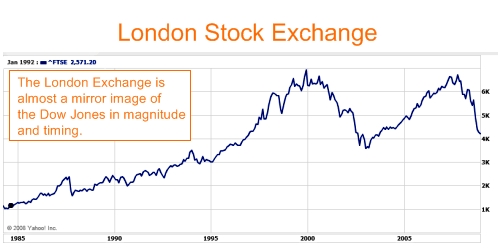

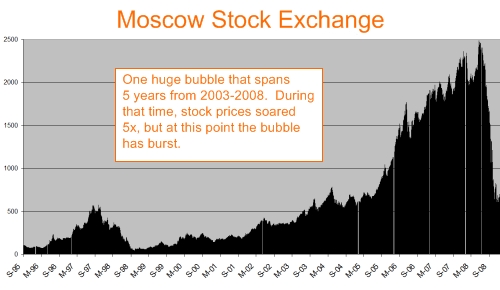

This post is called the Double Bubble, because it is clear that there have been two very significant bubbles to ripple through the world in the last 15 years. Just looking at the Dow Jones Industrial average, there is a bubble which begins circa 1995 and bottoms out circa 2003. Immediately after the tech bubble bottoms, a new bubble begins to form, which is the crisis we face today. As has already been discussed in previous blogs, Greenspan intentionally created a second bubble by lowering interest rates after the Tech Bubble popped.

Babies look great and a very very happy mother as well. Long time yes. Just though I’d surprise ya.

Hit me back just to chat some time. All of your and your family take care.

Paul Van Voorst

Former Gateway / Rob Knows me