How Global is the Bubble?

We keep on hearing that the current economic crisis is global in nature. That is to say, that each and every country in the world will suffer along with the United States. To be honest, this entire premise seems false to me. Surely there would be winners and losers as this economic crisis unfolds. Plus on top of this, the US is the largest debtor nation in the world. Surely the lenders will survive the crisis better than the debtors.

We keep on hearing that the current economic crisis is global in nature. That is to say, that each and every country in the world will suffer along with the United States. To be honest, this entire premise seems false to me. Surely there would be winners and losers as this economic crisis unfolds. Plus on top of this, the US is the largest debtor nation in the world. Surely the lenders will survive the crisis better than the debtors.

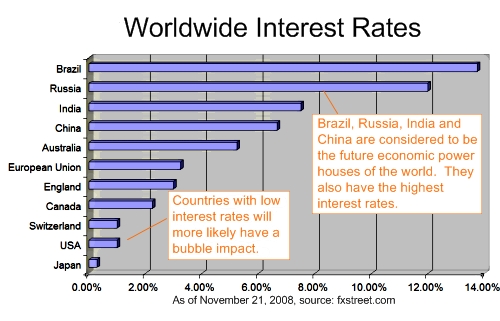

The chart below takes a peek at the interest rates around the world. The first thing that I notice is that there is a huge spread in interest rates from various countries. Their appears to be high interest rates in countries that are expanding such as China, Russia, India and Brazil. And then the balance of the countries have extremely low interest rates such as Japan, US, Europe and Great Britain. This chart is critical for understanding the economic crisis since artificially low interest rates are the root cause of the bubbles.

First, I took a look at the French stock market. The reason was to do a sanity check on the relationship between the dollar/euro, and the Dow Jones and the French stock market. As almost any investor knows, when interest rates go down, the stock market accelerates. The reasons are quite simple. Investors are constantly looking for higher returns, and as interest rates drop, the stock market spikes. This simple fact is one of the key underlying dynamics of the US financial crisis. The chart below shows clearly that the French market has experienced two bubbles and the timings are eerily similar to the Dow Jones bubble in the United States. Looks like at least to some degree that the Euro’s monetary policy was tied to US financial policy.

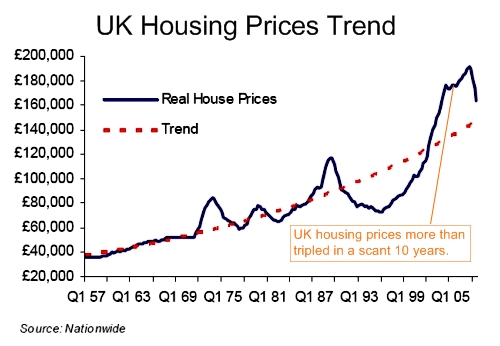

Next, let’s look at housing prices in Great Britain. Holy crap! In just 10 years, British housing prices have more than tripled from a low of £60,000 to a high of close to £200,000. Yes, the US had a housing bubble but in the same period of time, US prices did not even double. In this regard, the bubble is much more severe in Great Britain than the United States.

Looks like Europe may well be going down the tubes with the Americans. I was chatting with a friend in Europe last week, and he remarked that a European economist was worried that the entire Euro system might collapse in the next two years. Yikes.

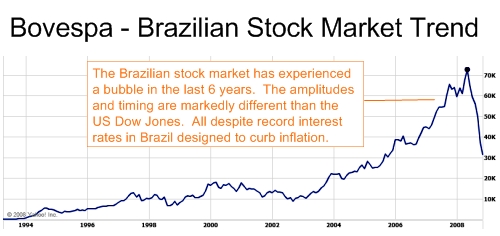

Below, you can find the performance of the Brazilian stock market, known as the Bovespa. To be honest, I was not expecting to see a bubble on this chart because Brazilian interest rates are the highest in the free world. With such high interest rates, why invest in the stock market if you can make 13% risk free? But lo and behold, there is a bubble! It does not have two peaks like the French, British and US stock markets, but there is one big pronounced peak. The good news is that it is correcting quickly. Since last 2007, the Bovespa has already lost more than 1/2 of its value. It makes sense to me, with high interest rates, there is less money to drive up prices, and less money to prop them up on the downside.

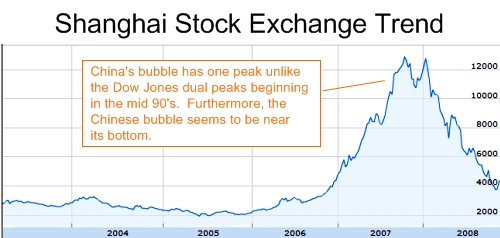

And last but not least is China. China like Brazil has experienced a bubble, but it seems to be only two years in length and it appears to be almost over. Of all the bubbles that I have analyzed the Chinese bubble looks to be the smallest. Now this is making sense. China has become the world’s bank, lending money to other nation’s at a record pace. Heck, China funded the American war in Iraq. China’s monetary policy has been almost perfect. China’s problem was exactly the opposite of the United States. China has been trying not to grow their economy too fast. Their fear was that if the economy grew too fast, that inflation would grow out of control.

But here’s the big news. In the last two months, Russia and Brazil have raised interest rates! One more time, they raised interest rates in the last two months. This at the time when America, Europe and Japan are lowering them to zero as fast as possible. I believe that interest rates are the key to monetary policy. When trying to correct a bubble, there is only one solution – raise interest rates. Raising interest rates contracts the money supply, and money moves out of higher risk ventures such as the stock market and mortgages.

Living down here in Brazil, I can tell you that the interest rates are real. I go to my bank once a month to check, and I am realizing well over 1% interest rate a month risk free. As the Brazilian stock market has fallen off a cliff, I just sit back and collect my interest. It is awesome, and it is truly the nest egg that I have always wanted to build.

I am going to be moving more money down to Brazil. The dollar has been rising lately against almost all major currencies, and in my view, this is the perfect time to be selling dollars.

I really love living in Brazil. One of the major reasons are the many fruits that can only be found in Brazil. Here is my list of favorites:

I really love living in Brazil. One of the major reasons are the many fruits that can only be found in Brazil. Here is my list of favorites: Here’s a trick that I figured out to speak Portuguese with less of a foreign accent. It goes back all the way back to elementary school. Do you remember when you were learning your vowels, and we learned that there are 5 vowels and each vowel has two sounds, long and short?

Here’s a trick that I figured out to speak Portuguese with less of a foreign accent. It goes back all the way back to elementary school. Do you remember when you were learning your vowels, and we learned that there are 5 vowels and each vowel has two sounds, long and short? One of the greatest travesties to this bubble is the incredible American deficit under the Bush administration. The deficit has ballooned by over $5T in a scant 8 years. We can all agree that this is highly fiscally irresponsible, but the question remains, “Where did all this money go?”

One of the greatest travesties to this bubble is the incredible American deficit under the Bush administration. The deficit has ballooned by over $5T in a scant 8 years. We can all agree that this is highly fiscally irresponsible, but the question remains, “Where did all this money go?”