The Bubble Recovery

One of the greatest travesties to this bubble is the incredible American deficit under the Bush administration. The deficit has ballooned by over $5T in a scant 8 years. We can all agree that this is highly fiscally irresponsible, but the question remains, “Where did all this money go?”

One of the greatest travesties to this bubble is the incredible American deficit under the Bush administration. The deficit has ballooned by over $5T in a scant 8 years. We can all agree that this is highly fiscally irresponsible, but the question remains, “Where did all this money go?”

After all, Bush is a Republican, and the funds certainly were not spent on liberal causes such as welfare and education. Given the record price at the gas pump, the funds were not spent on alternative energies, or more energy efficient cars. In fact, I think that we can look back at the success of the Humvee as a unique product of the Bush administration.

So show me the MONEY. By all estimates, the war in Iraq has cost $500B, but let’s be generous and assume that all the money has been squandered and there is no economic return on the American economy. Furthermore, let’s round it up to $1T. So there is still $4T unaccounted.

The chart above explains a large portion of the Bush’s incredible $5T deficit. One of the first things Bush did as president was honoring his campaign promise to give huge tax cuts to the wealthy. This was signed into law in June 2001.

The impact was swift. Government tax revenues essentially fell off a cliff during Bush’s first term. Bush’s rationale was that the tax cuts would trickle down to the rest of the economy and create jobs. This chart suggests the opposite. If jobs had been created, then revenues would not have fallen. In fact, they should have gone up. Bush’s tax cuts to the wealthy did not create jobs. In fact, these tax cuts have substantially increased the deficit and perhaps was one of the underlying contributors to the bubble.

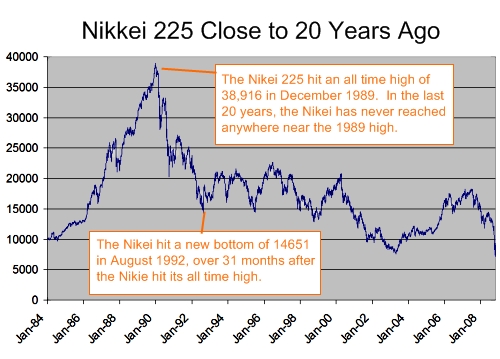

The Nikkei 225 is the Japanese version of the Dow Jones 500. This chart chronicles what is commonly referred to as the Japanese Asset Price Bubble. In addition to the run up in stocks, it was accompanied by a tremendous run up in real estate prices. Some places in Tokyo were being sold at over $100,000 a square foot. A square foot is the size of one floor tile, and it was selling for the price of an entire house. Sound familiar?

Once the bubble popped in 1989, the Japanese Federal Reserve continued to spur the economy by lowering interest rates and printing more money. These actions were ineffectual, and interest rates hit zero. Can you believe it? They were essentially giving away money and there were no takers. The credit crisis would not abate.

The last straw was when the government began to buy out failing banks and businesses creating what became known as zombie businesses. This era in Japanese history is known as the lost decade. Historians blame primarily the Japanese Feds insistence in lowering interest rates and bailing out failed institutions.

If you have not already figured out where this is going. We are repeating each and every mistake that happened in Japan beginning in the mid 80’s. We made the exact same mistakes as the Japanese that caused a stock and housing bubble. And now we are replicating their errors in resolving the problems. The end result for Japan was the lost decade, and perhaps the US is in store for a similar fate.