I am shocked at what is happening to our country right now. It is like an incredibly bad dream. I put together the following two charts (see below). The first chart is the history of the Dow Jones Industrial Average for the last 18 years. I drew a line (just a guess) of the normal sustainable rate of growth of the American economy. Independent on where you draw the line, it is easy to see 2 bubbles in the last 18 years. The first one is commonly referred to as the internet bubble or the dot com bust. And the second is the mess that we are experiencing. When looking at the magnitudes of the bubbles, they are similar in size. It is true that the DJ is not a surrogate for the market as a whole, but certainly if there is excess liquidity driving the mortgage market, then the DJ would at least have a residual bubble from the liquidity.

I am shocked at what is happening to our country right now. It is like an incredibly bad dream. I put together the following two charts (see below). The first chart is the history of the Dow Jones Industrial Average for the last 18 years. I drew a line (just a guess) of the normal sustainable rate of growth of the American economy. Independent on where you draw the line, it is easy to see 2 bubbles in the last 18 years. The first one is commonly referred to as the internet bubble or the dot com bust. And the second is the mess that we are experiencing. When looking at the magnitudes of the bubbles, they are similar in size. It is true that the DJ is not a surrogate for the market as a whole, but certainly if there is excess liquidity driving the mortgage market, then the DJ would at least have a residual bubble from the liquidity.

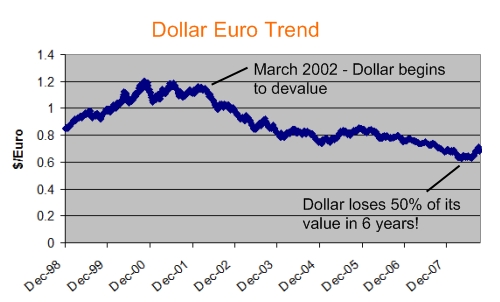

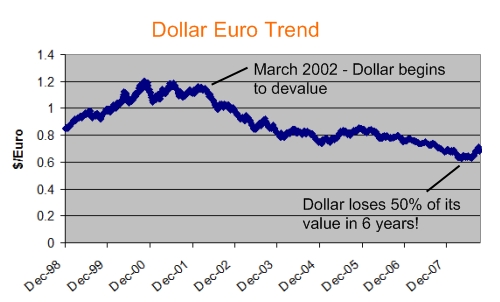

Which brings me to the second chart. If you look at the decline in the dollar, it almost exactly coincides in the rise in the Dow! I estimate the date of the bubble to be March 2002. First there is good news here. Bush says that the bubble began over 10 years ago. I don’t think so, and obviously the longer a bubble persists, the larger its magnitude.

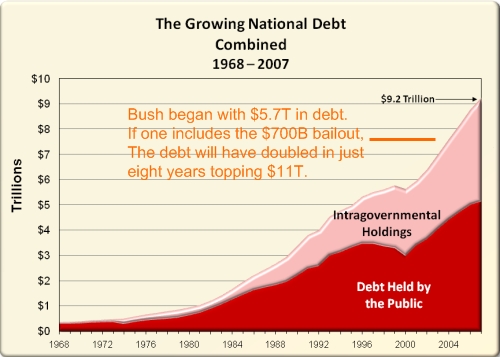

Now look at the dollar. It is clear that someone made a conscious decision to devalue the dollar. Now it makes sense to me! Here we have Republicans spending money like they won the lottery, and worse yet lowering taxes. But the kicker is that interest rates go DOWN! That makes no sense. Interest rates in Bush’s presidency are less than Clinton’s when we ran a surplus. How can that be? Something has to give, and it is the dollar.

Who would invest in the United States when interest rates are so low? No one. Of course, as the dollar weakens, investing in the US becomes more attractive so money flows into the economy. But this is all so upside down! People are investing in our country because we have a weak currency, not because we have a strong economy! Through out all of my life no matter what president, the dollar has always been strong. Until now. And not only has it fallen, it has fallen off a cliff. Why? It seems like there can only be one reason, to attract foreign capital. It is evident to anyone that this strategy is unsustainable and ultimately the bubble must burst.

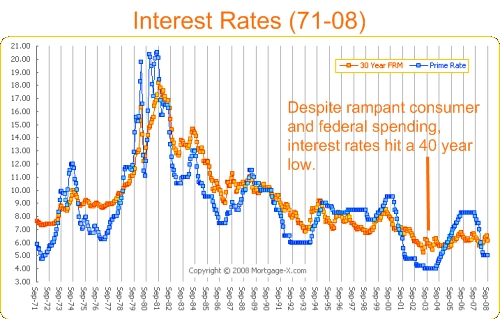

There is one conclusion that I can make. This is not something that happened to us. This is something that someone consciously did. The root of this problem is our money supply. Someone has been increasing the money supply at a much faster rate than our underlying economy can support. This is very very dangerous and I don’t believe it has happened in my life time until now. I do not know why someone would do something so hazardous with our economy, but I can speculate.

When the money supply increases, credit loosens automatically, the economy gets a bump. It is an artificial unsustainable bump, but nevertheless a bump. It is good politics to show economic growth, and so the Bush administration continued to force the dollar lower to show artificial economic growth. During the internet boom, although there was a bubble, there was at the core true economic growth. American companies such as eBay, Google, Yahoo became worldwide leaders of the internet. Furthermore the global demand for the internet, further entrenched American companies such as Intel, Microsoft, and Dell into the global economy. The bubble popped but underneath the economy was strong. Plus our goal was not to create a bubble. The reality is that the Bush administration was using the bubble as a proxy for economic growth. So once the bubble pops, what do we got underneath? NADA.

So who is responsible? Who would increase the money supply? There is only one person that has this responsibility. Federal Chairman, Alan Greenspan. Dude, what were you thinking? This is more than bad judgment, and I really can’t believe that greed would be a factor. What were you thinking? I do find it strange that as the entire country is running around like chickens without heads, that you remain silent.

I am not an economist. I am just a really concerned citizen, that wants to inject some analysis and thought into a dialog that appears to be lacking of both. Here are some conclusions. Take them for what they are worth.

Numbers. Economics are all about numbers. Economists are hard core mathematicians. But whenever we discuss this problem or the bailout, no one is quantifying anything. When did this problem begin? How large was the bubble? This is why I did my little quickie analysis, because it is a huge hole in our plan. The answer to this problem is in the numbers and no one is looking at the numbers. The only number we get to know is $700B. This is beyond pathetic. It is reckless and irresponsible.

Bubble size. Just based on my numbers, it seems that the relative size of the two bubbles are comparable. I agree that the Dow Jones is not a surrogate for the economy as a whole, but the last bubble burst without a bailout and we ended up OK. What is driving the panic? What makes us think that this is the worst since the Great Depression? Again, where are the numbers? We had a saying at Gateway, “In God We Trust, all others bring data.” Give us data that backs up the panic.

Responsibility. Let me make a key point. This should never happen. Never, never, never. It is someone’s job to watch critical indicators (also called fundamentals) such as the price of the dollar, unemployment, in flows of capital, and so on. The warning bells have been going off for years and no one has done anything to fix it. Worse yet, it is clear that the bad acts just continued unabated. Not only was this 100% preventable, it was easily preventable. We need to know who and why before we can trust again. This guy Paulson wants $700B of our money. Before this all happened, I had know idea who he was. Was he part of the problem? Or maybe he is incompetent? These questions must be asked, and no one Republican nor Democrat should be offended when they get asked.

Spending. What is the root of the problem? The Republicans from 2000-2006 have spent like no other Congress in the history of the nation. We have the biggest, humongous, behemoth government in the history of the WORLD. The waste turns my stomach, plus it is 100% contrary to the vision of the great Ronald Reagan. The smaller the government, the lower our taxes, and the less intrusion in our lives. The people in power are NOT Republicans nor are they Democrats, they are the worst of everything, and in my view, THEY ALL SHOULD LOSE THEIR JOBS. I am appalled by the spending in Washington as if God wrote a blank check, and said “Go have fun kids.” Geez.

Taxes. Then on top of that, they lower taxes. This is an abomination. Furthermore, anyone that opposes tax decreases, is labeled as UnAmerican or Liberal. These guys are so clueless. Every American has to balance a checkbook, and spend within their means. Is it so much to ask our government to do the same thing?

Balanced Budget. We have to demand that our officials live within their means. Increased spending should NEVER be coupled with lower taxes. It does not work that way in the real world. Does it bother anyone that the war was supposed to cost $50B and now we are going on $1000B? We need to instill a discipline in Washington that somehow has been thrown out the window in the last 8 years. This is the most important thing we can do.

I am going to say it out loud. People. America is BROKE. We are not the richest country in the world. Not even close. Why is our currency falling off a cliff? Because we do not have the money to peg our currency. All of our wealth has been squandered away. It is all gone. The only hope is that we start living within our means.

Panic. Stop the panic. Stop the panic. I do not want the people responsible for our economy in a panic. I want them thinking clear and looking at lots and lots of numbers. We need clear thinking and unemotional leaders looking for solutions. Not just quick fixes but real solutions. The Dow fell 700 points in a day. Big deal. We are dealing issues with much larger than that. I as a citizen want to know the root cause. I want assurances that we will never get in this situation again.

Let me say it again. I hate the panic. The chances we find an intelligent solution diminish greatly the more our leaders panic.

Conclusion In conclusion, I am not seeing evidence for the panic we are seeing from our leaders right now. Yes, we have a problem, and yes it will be painful. But we should not panic. If we made it through the internet bubble, can you not survive this bubble as well?

I have not yet heard anything from our leaders that indicates that anyone understands the true underlying problem, and I feel like they are just shooting in the dark. Lastly, I do not trust this man Paulsen with $700B of our money when he is the prototype Wall Street insider. Kudos to the Republicans for killing the $700B Panic Bailout Plan. There is a better solution out there if we only take the time to find it.

Why did I write this? Because I am disgusted to see how the President and Congress are behaving. It’s like watching Romper Room. We deserve better and we should demand it. If you agree, please pass this post on to as many people as possible. Thanks for reading.

Rob

Here’s a trick that I figured out to speak Portuguese with less of a foreign accent. It goes back all the way back to elementary school. Do you remember when you were learning your vowels, and we learned that there are 5 vowels and each vowel has two sounds, long and short?

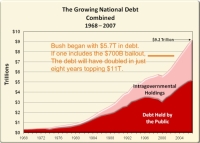

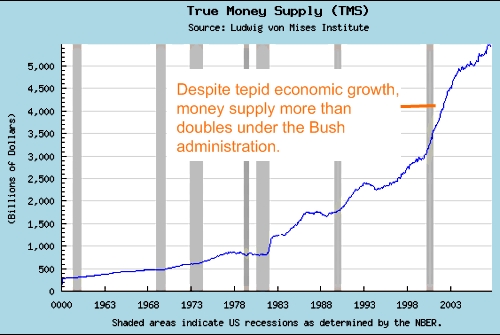

Here’s a trick that I figured out to speak Portuguese with less of a foreign accent. It goes back all the way back to elementary school. Do you remember when you were learning your vowels, and we learned that there are 5 vowels and each vowel has two sounds, long and short? One of the greatest travesties to this bubble is the incredible American deficit under the Bush administration. The deficit has ballooned by over $5T in a scant 8 years. We can all agree that this is highly fiscally irresponsible, but the question remains, “Where did all this money go?”

One of the greatest travesties to this bubble is the incredible American deficit under the Bush administration. The deficit has ballooned by over $5T in a scant 8 years. We can all agree that this is highly fiscally irresponsible, but the question remains, “Where did all this money go?”

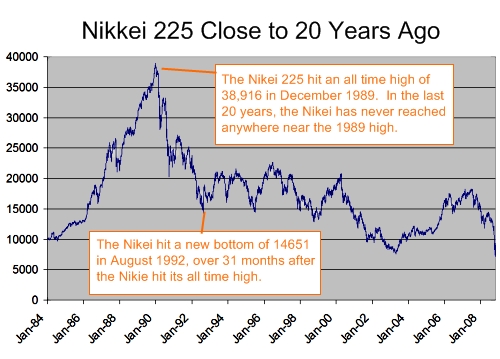

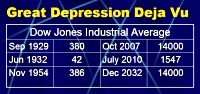

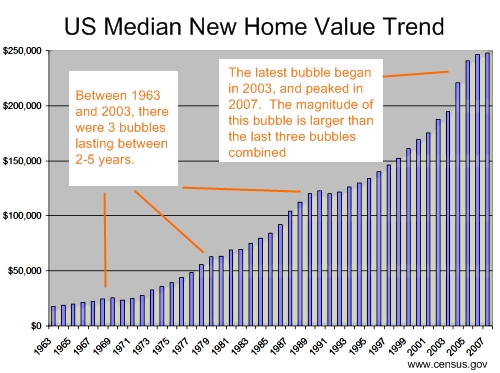

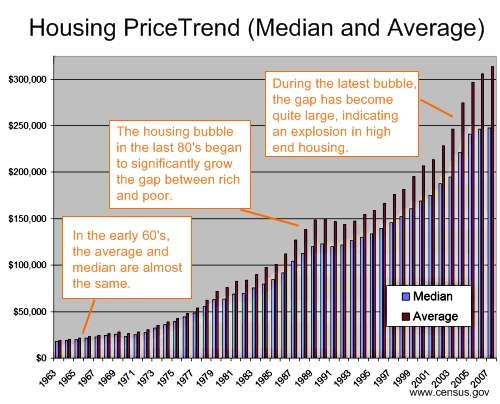

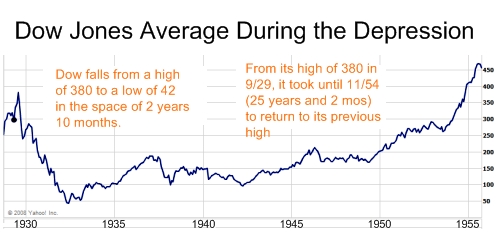

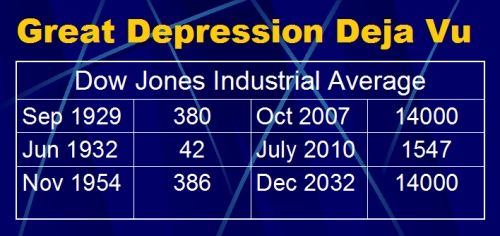

The media is calling this bubble the worst since the Great Depression. That sure sounds scary, but where are the facts? What makes them believe this bubble is so severe relative to other bubbles? Are there any facts to feed the panic or just pure fear?

The media is calling this bubble the worst since the Great Depression. That sure sounds scary, but where are the facts? What makes them believe this bubble is so severe relative to other bubbles? Are there any facts to feed the panic or just pure fear?

Yesterday, the House of Representatives approved the $700B bailout plan, and President Bush quickly signed it into law. Sigh! What I dislike most about this bill was that everyone including the President was acting in a panic. No one was calmly analyzing the underlying magnitude of the credit crisis, and the fundamentals that would drive our great country so close to the edge of a cliff. I’ll try to do that here.

Yesterday, the House of Representatives approved the $700B bailout plan, and President Bush quickly signed it into law. Sigh! What I dislike most about this bill was that everyone including the President was acting in a panic. No one was calmly analyzing the underlying magnitude of the credit crisis, and the fundamentals that would drive our great country so close to the edge of a cliff. I’ll try to do that here.

I am shocked at what is happening to our country right now. It is like an incredibly bad dream. I put together the following two charts (see below). The first chart is the history of the Dow Jones Industrial Average for the last 18 years. I drew a line (just a guess) of the normal sustainable rate of growth of the American economy. Independent on where you draw the line, it is easy to see 2 bubbles in the last 18 years. The first one is commonly referred to as the internet bubble or the dot com bust. And the second is the mess that we are experiencing. When looking at the magnitudes of the bubbles, they are similar in size. It is true that the DJ is not a surrogate for the market as a whole, but certainly if there is excess liquidity driving the mortgage market, then the DJ would at least have a residual bubble from the liquidity.

I am shocked at what is happening to our country right now. It is like an incredibly bad dream. I put together the following two charts (see below). The first chart is the history of the Dow Jones Industrial Average for the last 18 years. I drew a line (just a guess) of the normal sustainable rate of growth of the American economy. Independent on where you draw the line, it is easy to see 2 bubbles in the last 18 years. The first one is commonly referred to as the internet bubble or the dot com bust. And the second is the mess that we are experiencing. When looking at the magnitudes of the bubbles, they are similar in size. It is true that the DJ is not a surrogate for the market as a whole, but certainly if there is excess liquidity driving the mortgage market, then the DJ would at least have a residual bubble from the liquidity.

I watched the video and I think it is two views of the same thing. Here are two reasons why:

1. I tried to make the point about accents at the end of the post (probably not very well). The accented vowels (as in Spanish) indicate that that syllable should be accented. If there are no accents, then the accent by and large should be on the second to last syllable. When you accent the syllable, then at times there might be subtle changes in the pronunciation of the vowel, but a short-o is still a short-o. Either way, it is far more important to hit the accent on the right syllable than to modify the sound of the vowel.

2. I view dipthongs as being an extension of the above rule. In English, you are never sure which vowel sounds you are blending, and it is much more straight forward in Portuguese. Using the examples above, pão, would be short-o + long-o. mãe is short o + long a. And so on.

Anyways, my point was actually entirely different. One of the key things for English speakers is to remove certain vowel sounds such as short-e and short-i from their pronunciation.

Robert, I posted on Mike´s blog calling the attention to the fact that there are only 5 vowel sounds in spanish, but in portuguese, there are many more. First, you have open and closed vowels. Than you also have nasalised dithong vowels (like in pão, mãe, põe).

Check out the post and also this video from an english teacher, teaching about vowel sounds in portuguese.

http://www.youtube.com/watch?v=uGjLYgA2gtA